Fiscal Year Vs Calendar Year Tax – An accounting year, or tax year, is the time frame for keeping a business can choose to use a calendar year or a fiscal year. The 12 months beginning Jan. 1 and ending Dec. 31 constitute . Using a calendar year would artificially split up the most important time of year for a tax-prep business. That’s why if you look at H&R Block, you’ll notice that it uses a fiscal year that ends .

Fiscal Year Vs Calendar Year Tax

Source : www.thebalancemoney.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

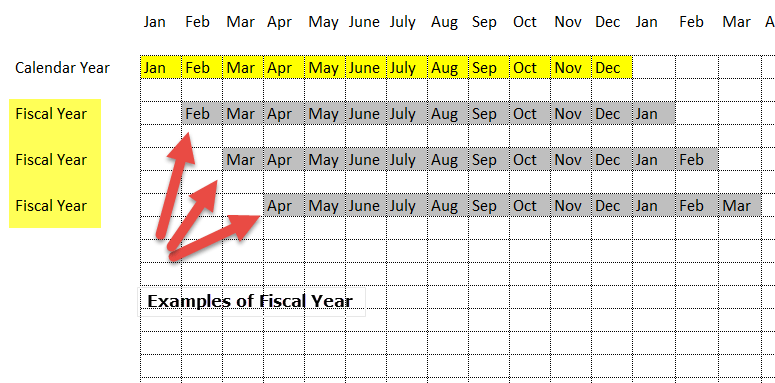

What is the difference between a fiscal year end and a calendar

Source : www.universalcpareview.com

Fiscal Year vs Calendar Year | Top 8 Differences You Must Know!

Source : www.wallstreetmojo.com

What Is Fiscal Year End? Definition and vs. Calendar Year End

Source : www.investopedia.com

Calendar Year vs Fiscal Year | Top 6 Differences You Should Know

Source : www.educba.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

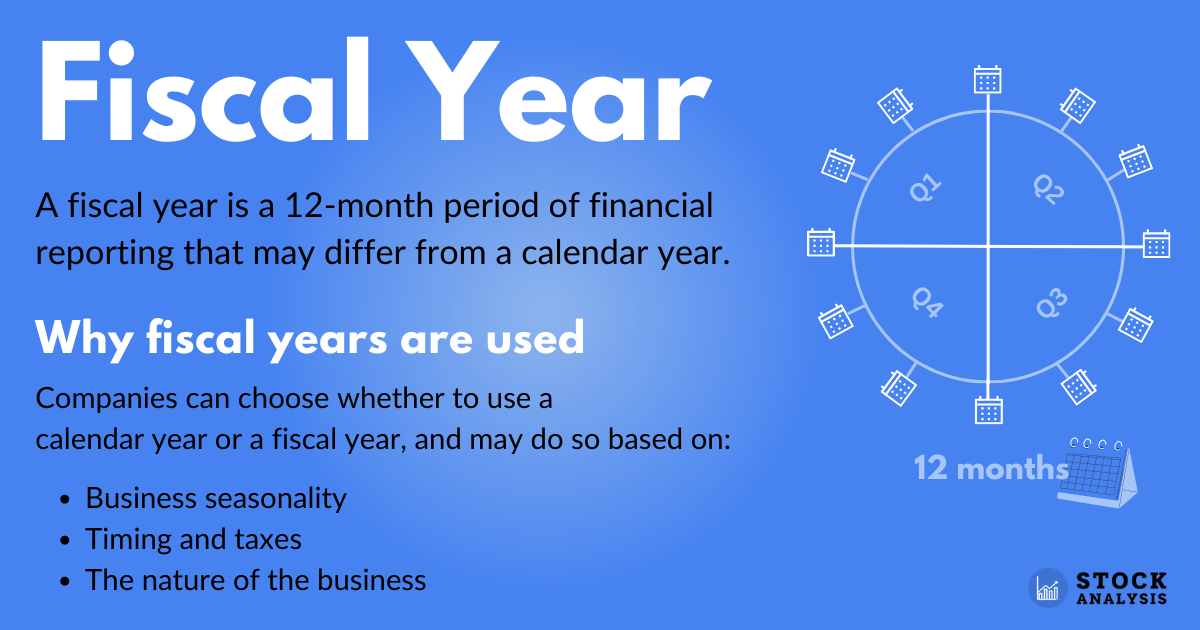

Fiscal Year: Definition, Use Cases, and Examples Stock Analysis

Source : stockanalysis.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

Fiscal Year vs. Calendar Year: Key Differences | by Blogwaly | Medium

Source : medium.com

Fiscal Year Vs Calendar Year Tax What Is a Fiscal Year?: If you make your fiscal year different from the calendar year, this can make it more difficult for you to audit your company’s books because your records will diverge from your tax records and . Guidelines for Fiscal Year A Fiscal year may or may not be based on a calendar year. In some Businesses, the fiscal year coincides with the tax year, making it easy for the owners to file their taxes .

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

:max_bytes(150000):strip_icc()/FiscalYear-End_v1-e3337960a07c4b9f9a9d394e934caca2.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.07.48AM-240bfff397eb407f9736d065e74f55ec.png)